Peotone School Committee: Issue $4.85M Bond to Cover Deficit, Maxing Out Debt Capacity

Peotone School Board Committee of the Whole Meeting | October 27, 2025

Article Summary

Peotone School District 207-U is preparing to issue up to $4.85 million in working cash bonds to cover a projected $4 million budget deficit for the current school year, a move that will exhaust its borrowing ability until 2032. The school board also reviewed the tentative 2025 tax levy, which, due to its size, will require a public Truth in Taxation hearing before its final adoption in December.

Peotone CUSD 207-U Financial Plan Key Points:

-

A working cash bond issuance of up to $4.85 million is proposed to offset a projected $4 million deficit.

-

The district will use the remaining $2.5 million from a 2024 bond sale to partially cover the shortfall.

-

The new bond sale will max out the district’s debt service capacity until levy year 2032.

-

The 2025 tax levy will be more than 5% over the prior year’s extension, triggering a mandatory Truth in Taxation hearing.

PEOTONE, Il. – Facing a projected $4 million budget deficit this school year, Peotone School District 207-U officials are planning to issue another series of working cash bonds, a temporary financial fix that will max out the district’s debt capacity for nearly a decade.

During a committee meeting on October 27, Business Manager Adrian Fulgencio presented a plan to issue up to $4.85 million in working cash bonds. The proceeds would be used to cover the shortfall after the district exhausts the remaining $2.5 million from its 2024 bond sale. Without the new issuance, cash flow projections show the district’s finances would be $3.8 million “in the red” by the end of the 2027 fiscal year.

“The district has relied on working cash bond proceeds as the primary mechanism to offset structural budget deficits and maintain operations,” Fulgencio stated in his presentation. “This temporary strategy has provided the district with the necessary liquidity for two decades.”

The new bond sale, however, comes at a cost. The move will fully utilize the district’s debt service extension base, leaving no additional capacity to issue more working cash bonds until levy year 2032. The estimated impact of the new debt on a median home valued at $360,000 would be an increase of approximately $92 per year. The board must hold three separate meetings to approve the bond issuance, with a goal of receiving the funds in February 2026.

Alongside the bond discussion, the board reviewed the tentative 2025 tax levy. Driven by a projected 11.85% increase in the district’s total property value and a 2.9% Consumer Price Index increase, the levy is expected to capture over $15.4 million for the district’s operating funds. Because the proposed levy is more than 5% higher than last year’s extension, the district is legally required to hold a Truth in Taxation hearing, scheduled to take place before the final levy is adopted at the December 15 board meeting.

Latest News Stories

Legislator urges leaders to focus on relief for Illinois’ high property taxes

Texas House, Illinois state senator sue 33 AWOL Democrats in Illinois court

Indiana Woman Identified as Victim in Fatal Wilmington-Peotone Road Crash

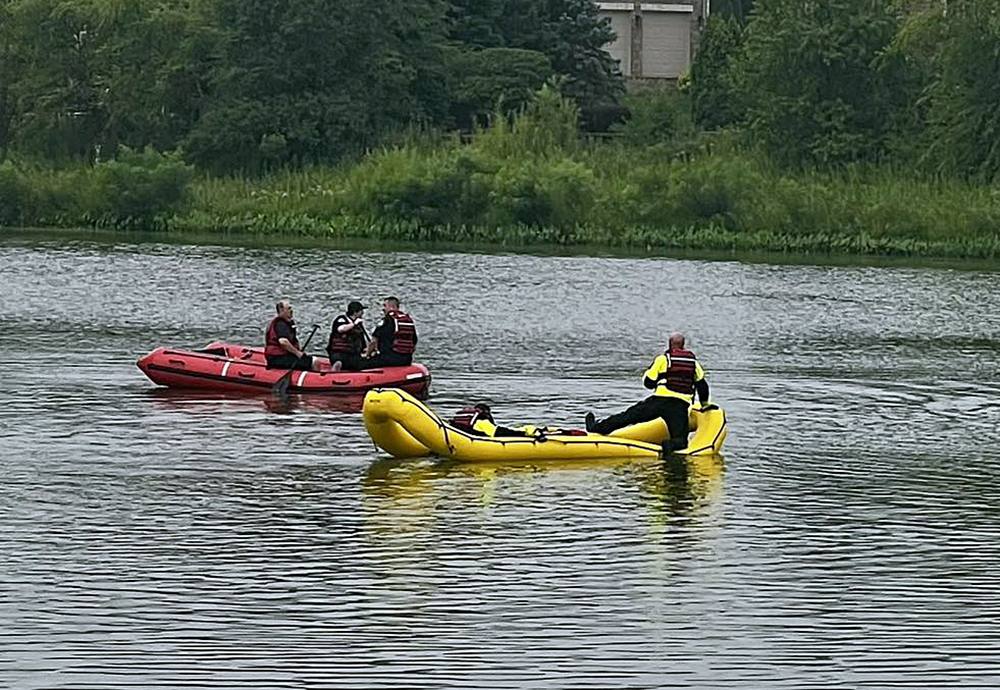

Multiple Agencies Rescue Person in Mental Health Crisis from Frankfort Pond

IT Consultant Urges Green Garden Township to Adopt Modern Cybersecurity Measures

Green Garden Township Forges Ahead with New Town Hall Plan, Faces Budget and Neighbor Concerns

Sanchez Family Unveils Major Redevelopment Plan for Monee Industrial Property

Monee Approves Over $566,000 Payment for New Public Works Facility Nearing Completion

Sheepdog Firearms Gets Green Light for Special Use Permit in Monee

Monee to Receive $250,000 Donation in Solar Project Agreement

Monee Board Sets Spending Plan with 2025-2026 Appropriations Ordinance

Monee Officials Issue Pool Safety Alert Amid Summer Heat