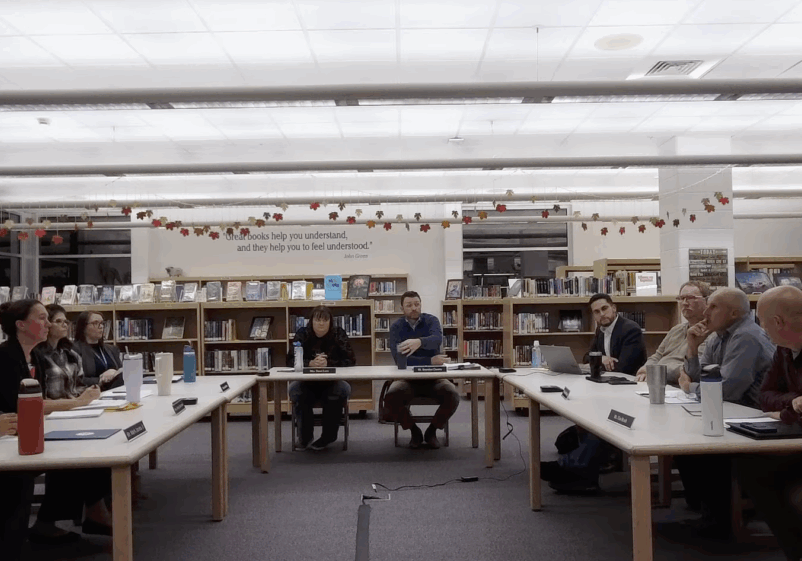

Peotone School Board Weighs Options for Paused Baseball Field Funds

Peotone School District 207-U Meeting | November 17, 2025

Article Summary:

With a major high school athletic field project on hold, the Peotone School District 207-U board is considering two financial options for the $4.8 million in 2023 working cash bond proceeds: abating the funds to lower annual debt payments for taxpayers or defeasing the bonds to pay them off early.

Bond Fund Options Key Points:

-

The funds are from the 2023 series working cash bonds, originally designated for new high school baseball and softball fields.

-

Option 1 (Abatement): Use the money to make annual debt payments, which would reduce the district’s debt service tax levy.

-

Option 2 (Defeasance): Place the funds in an escrow account to pay off the bonds early, a move that cannot be undone once initiated.

-

The board requested more information, including a total of money already spent on the project, before making a decision.

The Peotone School District 207-U Board of Education on Monday, November 17, 2025, began discussions on how to reallocate approximately $4.8 million in bond proceeds from a paused project to construct new high school baseball and softball fields.

Business Manager Adrian Fulgencio presented the board with two primary options for the 2023 working cash bond funds now that the project is on hold.

The first option is abatement, where the district would use the bond proceeds to make its annual debt service payments. This would reduce the amount of money the district needs to levy from taxpayers for its bond and interest fund, effectively lowering that portion of property tax bills. According to the presentation, this option offers more flexibility but would not allow the district to achieve present value savings by investing the funds.

The second option is defeasance. In this scenario, the proceeds would be transferred into an irrevocable escrow account to pay off callable bonds early. This would allow the district to potentially generate additional present value savings through investment but is an irreversible decision once started.

Board members did not lean toward either option, indicating a need for more information before any decision is made. A request was made for a sum total of all money spent to date on the athletic field project.

Board member Tim Stoub expressed caution, suggesting that taking action to pay off the bonds could be perceived negatively by the community, similar to a request for a tax increase. “I think calling the bonds is going to have the same effect as asking to increase the operating rate… in terms of community,” he stated.

The board took no action, and the funds will continue to be held while the district awaits further information and the results of a forthcoming facility master plan.

Latest News Stories

Arizona Chamber praises new interstate natural gas pipeline

Dems oppose Trump’s bid to end mail-in ballots, voting machines

After two weeks fleeing Texas, House Democrats return, quorum reached

Trump says court’s tariff decision could lead to ‘catastrophic’ collapse

Trump: Zelenskyy could end Russia-Ukraine war ‘if he wants to’

$750 million facility to protect Texas cattle, wildlife from screwworm threat

Chicago posts fewest homicides since 2016, arrests rate also declines

Three years later, Inflation Reduction Act blamed for higher Medicare costs

Illinois quick hits: Prosecutors charge two more in Tren de Aragua case; Senate Energy and Public Utilities Committee meets today; Illinois Little League team loses in World Series

Report: Human Rights Campaign pressures transgender procedures on minors

Everyday Economics: Housing market and Fed policy in focus in the week ahead

Executive Committee Considers $12,000 Strategic Planning Initiative with University of St. Francis