Everyday Economics: Can the newly appointed Fed governor make a compelling case?

We’ll hear from several Fed officials, including Chair Jerome Powell, following last week’s decision to cut the policy rate to 4.00–4.25%. The notable subplot: newly confirmed Fed Governor Stephen Miran cast the lone dissent, favoring a 50 bps move. He will also get to make his case this week. But for now, the evidence seems stacked against more rapid and larger rate cuts.

Powell described last week’s move as a risk-management cut – insurance against a sharper labor-market slowdown – while emphasizing vigilance on inflation. A larger 50 bp cut risks loosening financial conditions too quickly and de-anchoring inflation expectations – households and firms might bring purchases forward, adding price pressure. Markets could also question the Fed’s commitment to 2%, lifting inflation risk premium and the term premium, which would push longer-term Treasury yields higher. Paradoxically, that would raise, not lower, the borrowing rates that matter most for mortgages and investment. A measured 25 bp step manages labor-market risks without causing a major shift in inflation expectations. With core PCE drifting up since March (to 2.9% y/y in July), the bar for larger, immediate easing remains high.

Housing check-in: New-home sales will offer a fresh read on demand. Mortgage rates eased modestly in August versus July, and active listings have risen from a year ago, leaving conditions a bit more buyer-friendly in many markets. Although housing demand tends to fall this time of year, lower mortgage rates and record price cuts could support new construction home sales.

Data that matters: The Personal Consumption Expenditures (PCE) price index lands this week. Inflation progress has stalled on the margin; core PCE has firmed since spring. That, plus still-easy financial conditions relative to early summer support the Fed’s cautious gradual approach.

Labor market lens: Although labor demand has slowed, supply has also ticked down recently, keeping wage growth above a level consistent with 2% inflation. That combination also supports the “risk-management” framing: growth is cooling, but inflation isn’t a done deal.

Any renewed tariff pass-through could add near-term price pressure and complicate the Fed’s decision-making going forward.

Latest News Stories

Illinois trucker warns foreign firms faking logs, dodging rules, risking safety

Illinois law mandates pharmacies to sell needles, sparking safety debate

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

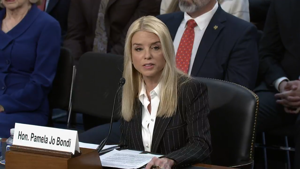

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

Meeting Summary and Briefs: Will County Board Executive Committee for August 14, 2025

Peotone Schools Face ‘Fiscal Cliff,’ Board Considers School Closures and New Construction

Public education budgets balloon while enrollment, proficiency, standards drop