Report: New York No. 2 in nation for inbound tobacco smuggling

New York remains one of the top states for inbound tobacco smuggling, according to a new report, which attributes the robust underground market to the state’s high tax burden and anti-smoking policies.

The nonpartisan Tax Foundation report ranked New York second behind California for inbound illegal tobacco smuggling, with an estimated revenue loss of more than $800,000 million in 2023, the latest year for which data is available. While the Empire State dropped from its No.1 ranking, the report estimates that 51.8 % of the cigarettes consumed in the state still come from the illegal market.

The report’s authors said the move by New York and other Northeast states to raise cigarette taxes and ban certain tobacco products has made cigarette smuggling both a national problem and a lucrative criminal enterprise.

“Higher tax rates can incentivize smuggling. As tax rates increase, consumers and suppliers search for ways around these costs,” said Adam Hoffer, the Tax Foundation’s director of excise tax policy. “In cigarette markets, consumers tend to shop across borders where the tax rates are lower, and dealers develop black and gray markets to sell illegally to consumers, paying little or no tax at all.”

Hoffer said growing cigarette tax levels and differentials “have made cigarette smuggling both a national problem and a lucrative criminal enterprise” that is depriving states of more than 4$ billion in tax revenue in 2023.

New York has the highest cigarette taxes in the nation, charging $5.35 in excise taxes per pack, compared to $3.51 in neighboring Massachusetts and $3.08 in Vermont. The state increased the rate by $1 per pack in 2023. New York City levies an additional excise tax of $1.50 per pack, bringing the combined tax rate to $6.85 in the Big Apple.

The state’s enforcement officials have been seizing a sizable amount of banned and untaxed vaping products linked to cross-border smuggling in recent years, including a 2023 New York City raid where authorities seized more than 1,800 cartons of cigarettes and $155,000 in cash. That’s costing the state millions of dollars a year in anti-smuggling enforcement, according to the report.

Other states in the Northeast region are also dealing with increased tobacco smuggling as they hike taxes on smokes and ban flavored vaping products. Massachusetts was ranked third in the nation for inbound tobacco smuggling, up from fourth highest in the Tax Foundation’s 2022 report.

Maine ranked 24th in the nation for inbound smuggling with more than $6.9 million in revenue losses while Connecticut ranked eleventh with more than $75 million in losses.

Virginia was the largest benefactor of smuggling-related cigarette tax revenue in 2023, netting more than $62 million, according to the report. Indiana was second highest, with net smuggling generating more than $61 million for the state.

“Legal markets suffer when untaxed and unregulated products receive significant competitive advantages from high taxes and prohibitions,” Hoffer said. “Illicit markets create additional dangers for consumers, and subsequently additional burdens on public health, and undermine both legitimate domestic businesses and state revenue generation.”

Latest News Stories

Report warns U.S. national debt predicted to pass $53 trillion by 2035

Courts remain firm against unsealing grand jury records from Epstein trial

White House TikTok garners 1.3 million views in 24 hours

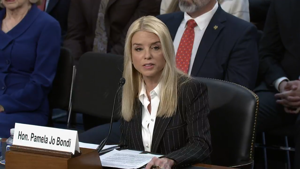

Newsom responds to Bondi’s letter on sanctuary policies

U.S., NATO military officials discuss Ukraine security guarantees

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

Meeting Summary and Briefs: Will County Board Executive Committee for August 14, 2025

Peotone Schools Face ‘Fiscal Cliff,’ Board Considers School Closures and New Construction

Public education budgets balloon while enrollment, proficiency, standards drop

Illinois news in brief: Cook County evaluates storm, flood damage; Giannoulias pushes for state regulation of auto insurance; State seeks seasonal snow plow drivers