Peotone School Board Weighs Options for Paused Baseball Field Funds

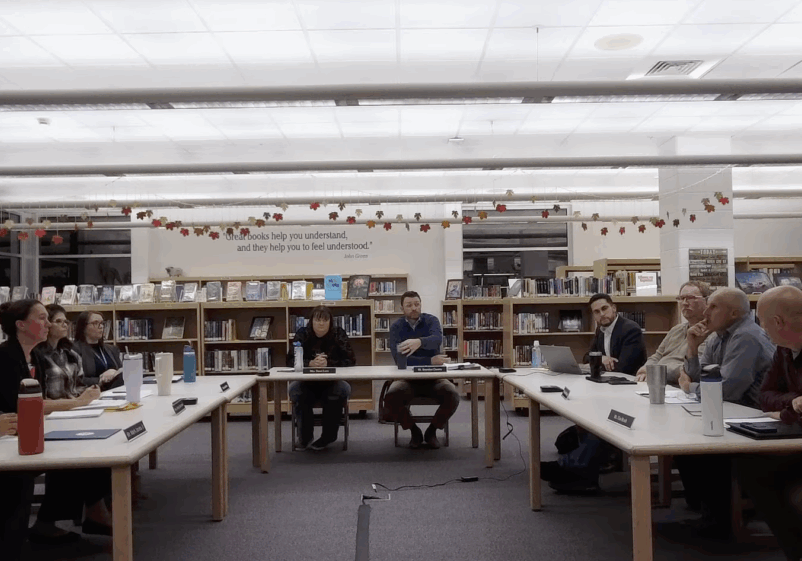

Peotone School District 207-U Meeting | November 17, 2025

Article Summary:

With a major high school athletic field project on hold, the Peotone School District 207-U board is considering two financial options for the $4.8 million in 2023 working cash bond proceeds: abating the funds to lower annual debt payments for taxpayers or defeasing the bonds to pay them off early.

Bond Fund Options Key Points:

-

The funds are from the 2023 series working cash bonds, originally designated for new high school baseball and softball fields.

-

Option 1 (Abatement): Use the money to make annual debt payments, which would reduce the district’s debt service tax levy.

-

Option 2 (Defeasance): Place the funds in an escrow account to pay off the bonds early, a move that cannot be undone once initiated.

-

The board requested more information, including a total of money already spent on the project, before making a decision.

The Peotone School District 207-U Board of Education on Monday, November 17, 2025, began discussions on how to reallocate approximately $4.8 million in bond proceeds from a paused project to construct new high school baseball and softball fields.

Business Manager Adrian Fulgencio presented the board with two primary options for the 2023 working cash bond funds now that the project is on hold.

The first option is abatement, where the district would use the bond proceeds to make its annual debt service payments. This would reduce the amount of money the district needs to levy from taxpayers for its bond and interest fund, effectively lowering that portion of property tax bills. According to the presentation, this option offers more flexibility but would not allow the district to achieve present value savings by investing the funds.

The second option is defeasance. In this scenario, the proceeds would be transferred into an irrevocable escrow account to pay off callable bonds early. This would allow the district to potentially generate additional present value savings through investment but is an irreversible decision once started.

Board members did not lean toward either option, indicating a need for more information before any decision is made. A request was made for a sum total of all money spent to date on the athletic field project.

Board member Tim Stoub expressed caution, suggesting that taking action to pay off the bonds could be perceived negatively by the community, similar to a request for a tax increase. “I think calling the bonds is going to have the same effect as asking to increase the operating rate… in terms of community,” he stated.

The board took no action, and the funds will continue to be held while the district awaits further information and the results of a forthcoming facility master plan.

Latest News Stories

Federal Lobbyists Brief Will County on Government Shutdown, Warn of SNAP and TSA Disruptions

Will County Committee Advances Gougar Road Bridge Project with Over $540,000 in Agreements

Commission Approves Mokena-Area Garage Variance Over Village’s Objection

Residents Clash on School Funding, Citing Low Tax Rate vs. “Wasteful” Spending at Committee Meeting

JJC Receives Surprise $1.9 Million from IRS Employee Retention Credit

JJC Advances ERP Modernization with New Vendor and Two-Year Budget

Will County Committee Shapes 2026 Legislative Agendas on Housing, Energy, and Health

JJC Authorizes Land Buy for Grundy County Expansion, Secures Site in Morris

Commission Grants Green Garden Solar Farm Project Variance Extension

Peotone School Committee: Issue $4.85M Bond to Cover Deficit, Maxing Out Debt Capacity

Will County Committee Advances Phased Takeover of Central Will Dial-A-Ride Service

Everyday Economics: Rate cut debate: Reading mixed signals in a fragile economy