City taxpayer burden swells, as Chicago pension debt rises

(The Center Square) – Chicago taxpayers now face unfunded debt from its municipal, laborers, police, fire and teachers’ pensions that exceed the overall debt of at least 44 states.

New Equable Institute data shows city taxpayers now face unfunded debt from its municipal, laborers, police, fire and teachers’ pension funds topping $53 billion, or more than the overall pension costs of at least 44 states.

Illinois Policy Institute policy researcher LyLena Estabine argues Chicago’s growing pension debt is raising just as many questions about the city’s long-term sustainability.

“It really means that they shouldn’t be looking to add on new costs and just recently the state signed in a pension sweetener that’s forecasted to add about $11 billion in additional liabilities by 2050,” Estabine told The Center Square. “Rather than being interested in solving the pension crisis and finding ways to address the very real costs that are adding on taxes that are driving people out of our city, lawmakers are content to continue kicking the can down the road.”

With Chicago businesses and residents already paying among the highest property tax rates in the country and lawmakers having only recently passed the aforementioned sweetener restoring benefits for older workers, Estabine warns the cost to the city could soon become even greater.

“As the city continues to add more debt, it’s just going to continue driving away businesses and residents,” she said. “Chicagoans are paying more than their fair share when it comes to supporting the pension system. It’s not that we don’t want to support our public workers, but it gets to a certain point that the spending becomes irresponsible and that’s what the concern is.”

With as many as seven Chicago-area pension funds now holding spots among the 10 worst-funded local pension plans across the country, Estabine worries it may not be long before city residents likewise start feeling more pain.

“Illinois has other cities where this has caused issues,” she said. “In the city of Harvey, they had to make service cuts, lay-off part of their workforce in order to pay for their pensions, and so we can expect that Chicago, if they haven’t already begun to enter that period, very soon we could see a similar issue happening.”

With all four of the city’s main pension systems already being below 40% covered, experts warn those funds have already crossed over into a danger zone.

Latest News Stories

D.C. attorney general sues Trump administration, claiming ‘unlawful’ takeover

What’s on the table for Trump’s meeting with Putin?

WATCH: Illinois In Focus Daily | Friday Aug. 15th, 2025

Federal government to drop 300,000 workers this year

Illinois quick hits: Ex-student sentenced for school gun, time served; fall semester beginning

Report Finding Few Trucks Littering Sparks Debate on Cleanup Responsibility

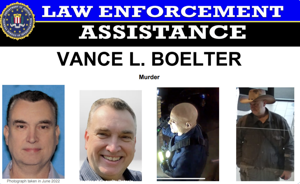

Grand jury indicts accused killer of Minnesota lawmaker

Sailors return to San Diego after extended Navy deployment

Under pressure, RFK Jr. brings back childhood vaccine safety committee

Illinois quick hits: Search continues for Gibson City suspect; manufacturing declines since 2000

Vance praises troops as backbone of Trump’s peace campaign

Foreign leaders wait for ruling in U.S. case on Trump’s tariff power