State officials urge Trump, Congress to address national debt

Indiana Gov. Mike Braun and a coalition of state financial officers and lawmakers are urging Congress and President Donald Trump to address the national debt crisis before the nation’s 250th birthday.

The group sent a letter to Congress and the president pushing for action on the federal government’s $38 trillion in debt.

“The national debt represents one of the most urgent and consequential challenges facing our nation,” the letter said. “We ask that this matter be given top priority due to the threat it poses to the financial stability of the United States, the dollar as the reserve currency and our position of global leadership.”

The letter requests that Congress and the president develop a plan before the 250th anniversary of the Declaration of Independence on July 4, 2026.

The State Financial Officers Foundation letter noted that the cost of interest on the nation’s debt is constraining spending on other programs.

“Our ability to service the debt is waning,” according to the letter. “Annual interest payments now surpass each of the annual budgets of the United States Military and Medicare. Without decisive action, the cost of debt service is projected to surpass the annual expenditures for Social Security.”

The group further noted that the national Social Security trust funds are expected to become insolvent in 2033, and financial challenges loom for both Medicare and Medicaid.

“We must come together so our children and grandchildren do not go off the fiscal cliff with debt we cannot pay,” according to the letter. “A long-term plan for debt reduction is essential, and our states stand firmly behind you in setting the vision to restore the financial strength of our nation.”

Indiana State Comptroller Elise Nieshalla, among more than 30 state financial officers who signed the letter, told The Center Square that the group wants to start a broader coalition at the state level.

“We are actively working to build a movement and really a mandate from the states to restore our country’s financial solvency,” she said.

Indiana is one of fewer than 20 U.S. states that holds a AAA credit rating, or what credit-rating agencies see as the lowest risk of default.

The federal government lost its last AAA rating in May when Moody’s downgraded the U.S. credit rating to AA1, projecting that Congress will be unable to reduce the nation’s growing debt. Moody’s was the last credit rating agency to maintain the U.S. at a top AAA rating. Fitch Ratings downgraded the U.S. in 2023, and S&P Global Ratings did so 2011. Moody’s said it didn’t see any budget proposals that would address the country’s more than two decades of deficit spending.

In the past half-century, the federal government has ended a fiscal year with a budget surplus four times, most recently in 2001. Congress has run a deficit every year since then regardless of which party held control of Congress or the White House.

Despite Indiana’s strong financial position, the state relies heavily on federal spending, nearly all of which is funded with borrowed money, Nieshalla said.

“We are in a rock-solid financial position, but we can’t help but see the pending problem of the national debt and how that makes us as a state … very vulnerable,” she told The Center Square.

Nieshalla said one step that federal lawmakers can take is to pass a balanced budget, something that has eluded Congress for more than two decades.

“We’ve got to stop the bleeding, because with the deficit spending that we are doing every year, it’s absolutely unsustainable, reckless and dangerous,” she told The Center Square. “So getting us back to a balanced budget is a very necessary step to deal with the growing debt problem.”

The fiscal year 2025 deficit was approximately $1.8 trillion, marking the sixth consecutive year that the deficit exceeded $1 trillion. The growing national debt is largely the result of Congress spending more money than it collects, along with increasing costs for Medicare and Social Security as the U.S. population ages and healthcare costs rise. The federal government has to pay more in interest as it accumulates debt.

In March, Trump said he wanted Congress to approve a balanced budget. That didn’t happen. Republicans and Democrats in Congress failed to pass spending bills on time and the government was shut down for a record 43 days. Congress has until Jan. 30 to approve those spending bills before the next funding lapse.

Latest News Stories

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

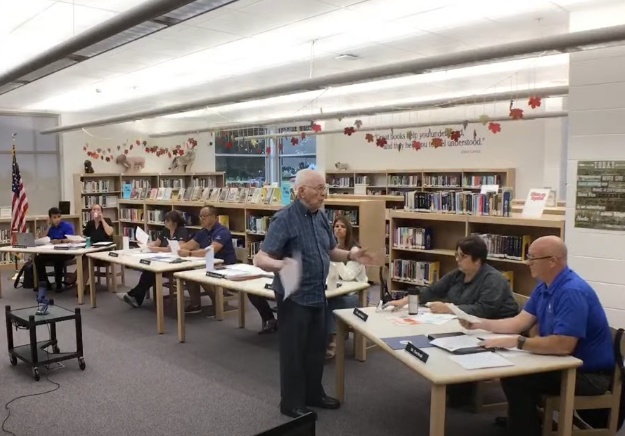

Meeting Summary and Briefs: Will County Board Executive Committee for August 14, 2025

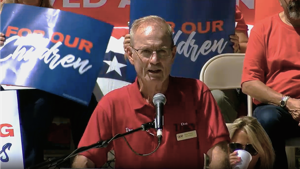

Peotone Schools Face ‘Fiscal Cliff,’ Board Considers School Closures and New Construction

Public education budgets balloon while enrollment, proficiency, standards drop

Illinois news in brief: Cook County evaluates storm, flood damage; Giannoulias pushes for state regulation of auto insurance; State seeks seasonal snow plow drivers

Governor defends mental health mandate, rejects parental consent plan

Illinois quick hits: Arlington Heights trustees pass grocery tax

Plan launched to place redistricting amendment before voters in 2026

Illinois GOP U.S. Senate candidates point to economy, Trump gains

Facing Budget Crisis, Peotone Committee Questions Athletic Field Project