Tribal members want 15 minutes for oral arguments in tariff case

Blackfeet Nation members asked the Supreme Court on Monday to set aside 15 minutes during oral arguments in the case challenging President Donald Trump’s tariffs.

Montana state Sen. Susan Webber, rancher Jonathan St. Goddard, and Rhonda and David Mountain Chief previously asked the nation’s highest court to allow them to intervene in the case because Trump’s tariffs “directly burden cross-border commerce of these tribal plaintiffs, who operate small businesses and family ranches near the U.S.-Canada border.”

The Supreme Court hasn’t ruled on the request to intervene. Solicitor General D. John Sauer opposed the request to intervene on behalf of the Trump administration. He said lower courts should address the tribal issues before consideration in the existing tariff case.

Webber’s latest motion, filed by attorney Monica Tranel, says the group “contends that the President does not have the authority to impose tariffs on cross-border tribal commerce” and that the Executive Orders at issue in this case violate the Indian Commerce Clause and four treaties: Jay’s Treaty of 1794, including its explanatory note (1796), and the Treaties of Greenville (1795), Ghent (1814), and Spring Wells (1815).

“These unique issues are not addressed by the other parties,” according to the motion. “Webber believes that oral argument addressing the specific issue of the executive branch’s authority to impose tariffs on tribal commerce will be of material assistance to the Court.”

The Supreme Court set oral arguments for Nov. 5 in the case, which is critical to a wide range of Trump’s economic agenda.

Trump has made tariffs the centerpiece of his economic agenda. Trump used a 1977 law that doesn’t mention tariffs to reorder global trade in a matter of months through tariffs to try to give U.S. businesses an advantage in the world market. Using tariffs under the International Emergency Economic Powers Act, Trump put import duties of at least 10% on every nation that does business with the U.S.

The challengers argue that Congress, not the president, retains the power to tax. Trump says he has the authority and that his deals around the world benefit all Americans.

Trump’s new tariffs raised $80.3 billion in revenue between January 2025 and July 2025 before accounting for income and payroll tax offsets, according to an analysis of federal data from the Penn Wharton Budget Model.

The Congressional Budget Office estimated that Trump’s tariffs could generate $4 trillion in revenue over the next decade, but they would raise consumer prices and reduce the purchasing power of U.S. families.

In August, the U.S. Court of Appeals for the Federal Circuit affirmed a previous lower court ruling, but said Trump’s tariffs could remain in place while the administration appeals to the U.S. Supreme Court.

In the 7-4 decision, the majority of the Federal Circuit said that tariff authority rests with Congress. It used that same language: “We discern no clear congressional authorization by IEEPA for tariffs of the magnitude of the Reciprocal Tariffs and Trafficking Tariffs. Reading the phrase ‘regulate … importation’ to include imposing these tariffs is ‘a wafer-thin reed on which to rest such sweeping power.'”

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods that the importer pays, not the producer. The importer pays the cost of the duties directly to U.S. Customs and Border Protection, a federal agency.

Latest News Stories

Illinois quick hits: Deer harvest totals; IHSA voting begins

Texas officials seek to establish Turning Point chapters

Peotone School District Honors Nearly 90 Students for High Achievement on State Exams

National Guard member shot near White House dies

New Bar Approved in Frankfort Despite Board Opposition

Chicago tenant groups call for eviction moratorium amid ICE raids

Illinois tax proposals dampen decline in small business uncertainty index

JJC Board Approves Grundy County Land Purchase Amid Heated Debate

‘Trouble in Toyland’ report sounds alarm on AI toys

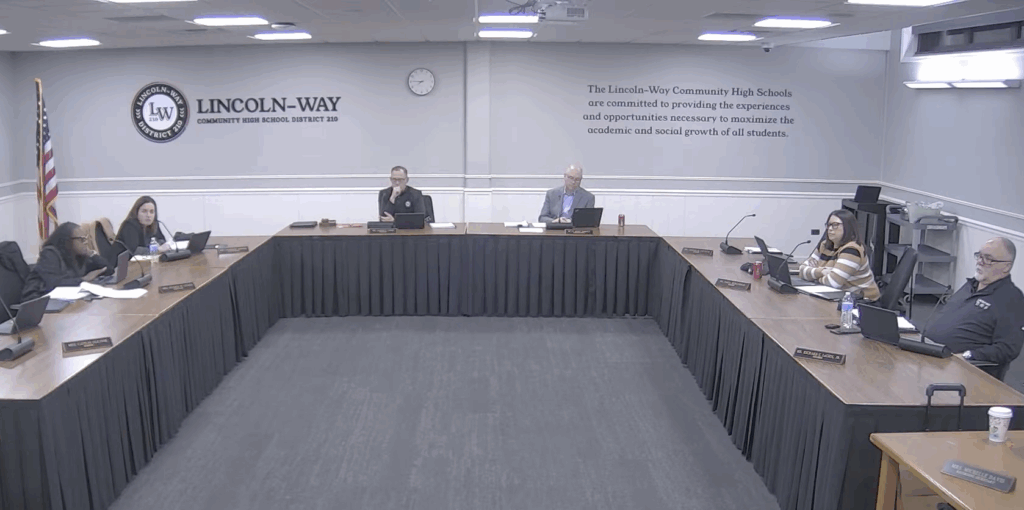

Support Staff Urge Lincoln-Way 210 Board for ‘Fair Contract’ During Public Comment

When was the first Thanksgiving? It’s actually up for debate

Spirit of Thanksgiving in Galveston: Resilience, rebirth, renewal out of rubble