WATCH: Ex-Illinois governor pushes for ‘millionaire’s surcharge’ amendment

(The Center Square) – The push continues to have voters if Illinois should be a 3% surcharge on millionaires.

Former Illinois Gov. Pat Quinn this week relaunched his effort to bring about the ballot referendum after the nonbinding question was approved in 2024. He stopped at the state capitol in Springfield on Wednesday.

“We need a millionaire amendment for property tax relief for families and businesses all across Illinois,” Quinn told reporters.

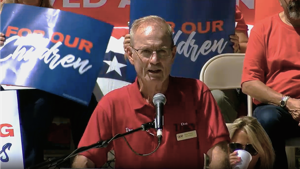

Republican U.S. Senate candidate Don Tracy said such a tax will push higher earners out of the state.

“They can’t, you know, can’t control spending,” Tracy told The Center Square. “So they have to ever increase taxes. And then they always want to tax the rich. But where has that ever worked?”

Quinn is pushing for the binding measure to be approved by legislators by May 3 in order to be placed on the November ballot.

The amendment, if approved, would allow the state to levy a 3% surcharge on millionaires for a property tax relief fund.

“According to the Illinois Department of Revenue, this millionaire’s surcharge for property tax relief would raise $4.5 billion,” Quinn said. “That’s a lot of money.”

Tracy said the best way to alleviate the property tax burden on property owners in Illinois is to elect more Republicans.

“With good, competent management of the government, you can hold the line on property taxes. But, and especially if you’re not doing giveaway programs,” Tracy said. “That sounds overly simplistic, but the solution is to elect Republicans and competent managers of government.”

Tracy warned a millionaire’s tax would encourage high earners to leave the state.

Illinois has among the highest property tax rates in the country.

Latest News Stories

Illinois quick hits: Governor bans school fines; Target fires hundreds over fraud

Industry advocates: More state regulation will drive insurance rates higher

Lawmakers, policy groups react to social media warning suit

Meeting Summary and Briefs: Will County Board Executive Committee for August 14, 2025

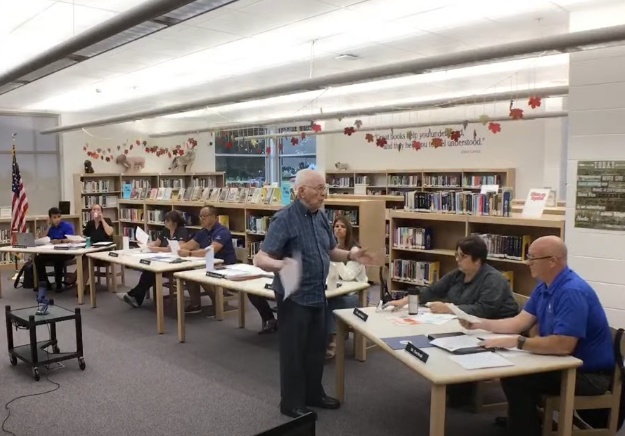

Peotone Schools Face ‘Fiscal Cliff,’ Board Considers School Closures and New Construction

Public education budgets balloon while enrollment, proficiency, standards drop

Illinois news in brief: Cook County evaluates storm, flood damage; Giannoulias pushes for state regulation of auto insurance; State seeks seasonal snow plow drivers

Governor defends mental health mandate, rejects parental consent plan

Illinois quick hits: Arlington Heights trustees pass grocery tax

Plan launched to place redistricting amendment before voters in 2026

Illinois GOP U.S. Senate candidates point to economy, Trump gains

Facing Budget Crisis, Peotone Committee Questions Athletic Field Project