Will County Board Passes 0% Tax Levy, Creating “Unbalanced” Budget Crisis

Will County Board Meeting | November 2025

Article Summary: In a contentious fiscal showdown, the Will County Board voted to keep the corporate property tax levy flat, rejecting a proposed inflationary increase despite having just passed a budget that relied on that revenue. The move forces the county to either cut operational costs significantly or dip into its $94 million cash reserves to cover the resulting shortfall.

Will County Budget Key Points:

-

Levy Freeze: The Board voted 12-10 to approve a corporate tax levy that captures only new construction, rejecting the 1.75% Consumer Price Index (CPI) increase included in the draft budget.

-

Cannabis Fund Shakeup: A Republican-led amendment reallocated over $2 million in cannabis tax revenue, stripping funding from some social service agencies to fund a ballot inserter, school safety glass, and scholarships.

-

Fiscal Disconnect: State’s Attorney representatives warned the board that passing a higher spending budget without the matching tax levy creates a legal and operational incongruency.

-

Cash Reserves: Proponents of the tax freeze pointed to the county’s healthy cash reserves (currently at 33% of operating expenses) as a means to plug the budget gap.

JOLIET – The Will County Board on Thursday, November 20, 2025, voted to freeze the county’s property tax levy at last year’s levels, rejecting a proposed inflationary increase and setting the stage for a potential fiscal standoff in the coming year.

The meeting was dominated by a split vote that largely followed party lines. The board ultimately approved a “0% increase” levy, capturing tax revenue only from new construction while forgoing an allowed 1.75% increase tied to the Consumer Price Index. This decision came moments after the board approved a fiscal year 2026 budget that had been built on the assumption of receiving that 1.75% revenue increase.

“The levy drives the budget,” argued Board Member Judy Ogalla (R-Monee), contending that if the board restricts the revenue, county staff must find the necessary cuts. “We levy for a certain dollar amount… Staff then made the cuts appropriately because we cannot make cuts to the great detail of everything.”

Cannabis Funding Overhauled

Before the final budget vote, the board engaged in a heated debate over the use of cannabis tax revenue. Board Member Jim Richmond (R-Mokena) introduced an amendment to redirect approximately $2 million in cannabis funds away from the County Executive’s proposed plan.

Richmond’s amendment, which passed 12-10, allocated the funds as follows:

-

$440,000 for Housing Stabilization.

-

$350,000 for a new Scholarship Fund.

-

$335,000 for the Children’s Advocacy Center (CAC).

-

$260,000 for a ballot inserter for the County Clerk’s office.

-

$200,000 for the Regional Office of Education (ROE) for safety glass in schools.

-

$200,000 for legal defense for immigrants with legal status.

-

$170,000 for Workforce Services.

-

$50,000 for Food Stability (Senior Produce).

Board Member Elnalyn Costa (D-Bolingbrook) attempted to counter this with an amendment allocating funds by percentage rather than specific dollar amounts to organizations, arguing for more transparency and vetting. Her counter-proposal failed 10-12.

The Levy Showdown

The tension peaked when the board addressed the corporate levy. Finance Chair Sherry Newquist (D-Steger) and the State’s Attorney’s office warned that passing a budget with higher spending authority while cutting the revenue source could lead to an unbalanced budget.

“Using our reserves for operating expenses could cause our credit rating to drop and that could ultimately cost us more money in the long run,” Newquist cautioned.

Board Member Steve Balich (R-Homer Glen) dismissed concerns about finding cuts, suggesting a broad reduction was feasible. “If it was up to me, I’d be cutting 10% out of every line item,” Balich said. “I like the health department, but good god, how much money are we going to spend?”

Despite the warnings, the 0% levy passed. County finance staff confirmed during the meeting that the corporate fund currently holds approximately $94.8 million in cash reserves, which is approximately 33% of operating expenses—well above the county’s targeted policy of 25%.

Latest News Stories

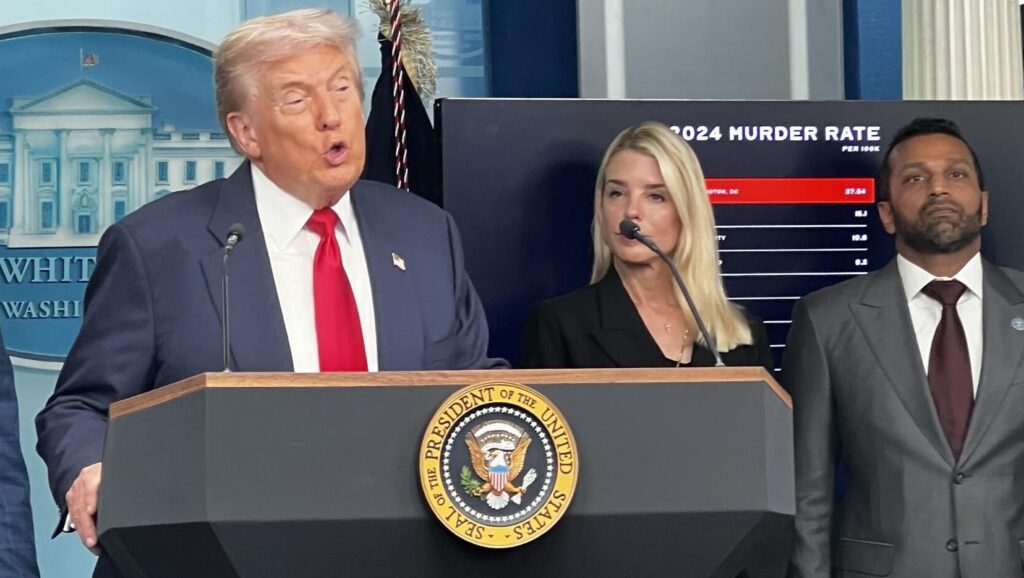

WATCH: Trump admin asks SCOTUS to lift Guard restraints; Pritzker opposes ‘head tax’

Poll: Voters trust local governments more than feds to address crime, other issues

Illinois quick hits: Secretary of State accuses ICE of plate swapping; Treasurer celebrates LGBTQ+

Lincoln-Way to Purchase New Buses, Add Smaller Vehicles to Address Driver Shortage

WATCH: Pritzker ‘absolutely, foursquare opposed’ to Chicago mayor’s head tax

Illinois quick hits: Elections board splits on Harmon fine; busiest summer at O’Hare

Trump administration asks Supreme Court to toss stay in National Guard case

GOP candidates: Illinois families struggle while Pritzker wins in Las Vegas

WATCH: Pritzker wants immigration enforcement, just not Trump’s way

‘Legal minefield:’ Biometrics reforms needed to keep IL tech biz growing

Chicago transit violent crime at 7 year high, funding concerns persist

WATCH: National Guard case before SCOTUS; Trump insists China soybean deal coming